Fraud Article

Fraud prevention teams: Why you need one

Effective fraud prevention shouldn’t be about providing a one-off, one-size-fits all product. So, how do anti-fraud teams develop and fine-tune their solutions? And how do providers help clients integrate them into dynamic, adaptive anti-fraud strategies?

Fraud is an increasingly serious problem in the digital world, where the use of stolen personal information imperils honest customers. One of the most common methods of fraud is identity theft, in which criminals steal personally identifiable information from their victims.

This can include personal information like names, addresses, phone numbers, and details used for mobile banking, like bank account numbers and credit card numbers. By obtaining this information, criminals can illegitimately access accounts, make fraudulent purchases, and sell honest customers’ details online.

Aside from the online world, fraud can occur through phone calls and other day-to-day activities, necessitating caution at all times. Businesses must take fraud prevention seriously, or risk harm to customers, reputational damage, and attention from law enforcement.

For businesses, the task for fraud prevention teams is simple to define: stop bad actors from doing what they want to do while making sure the honest customers get to do what they want without any hindrance. However, achieving this goal is far from simple, and requires constant innovation, implementation, review, and refinement.

Online anti-fraud solutions are built around four key pillars: device intelligence, session intelligence, dynamic intelligence, and expert intelligence. Within each of these pillars, fraud prevention teams are constantly innovating and introducing new techniques to refine anti-fraud strategies.

Four pillars of anti-fraud strategies

Device Intelligence

At the base of the pyramid is data about the machine being used for a session, from basic information such as the IP address to more advanced behavioral signals. This information can be extremely useful for detecting repeat fraudsters, who often use the same device to launch multiple attacks against the same customer, or against multiple targets, over a period of time.

Elements within a session

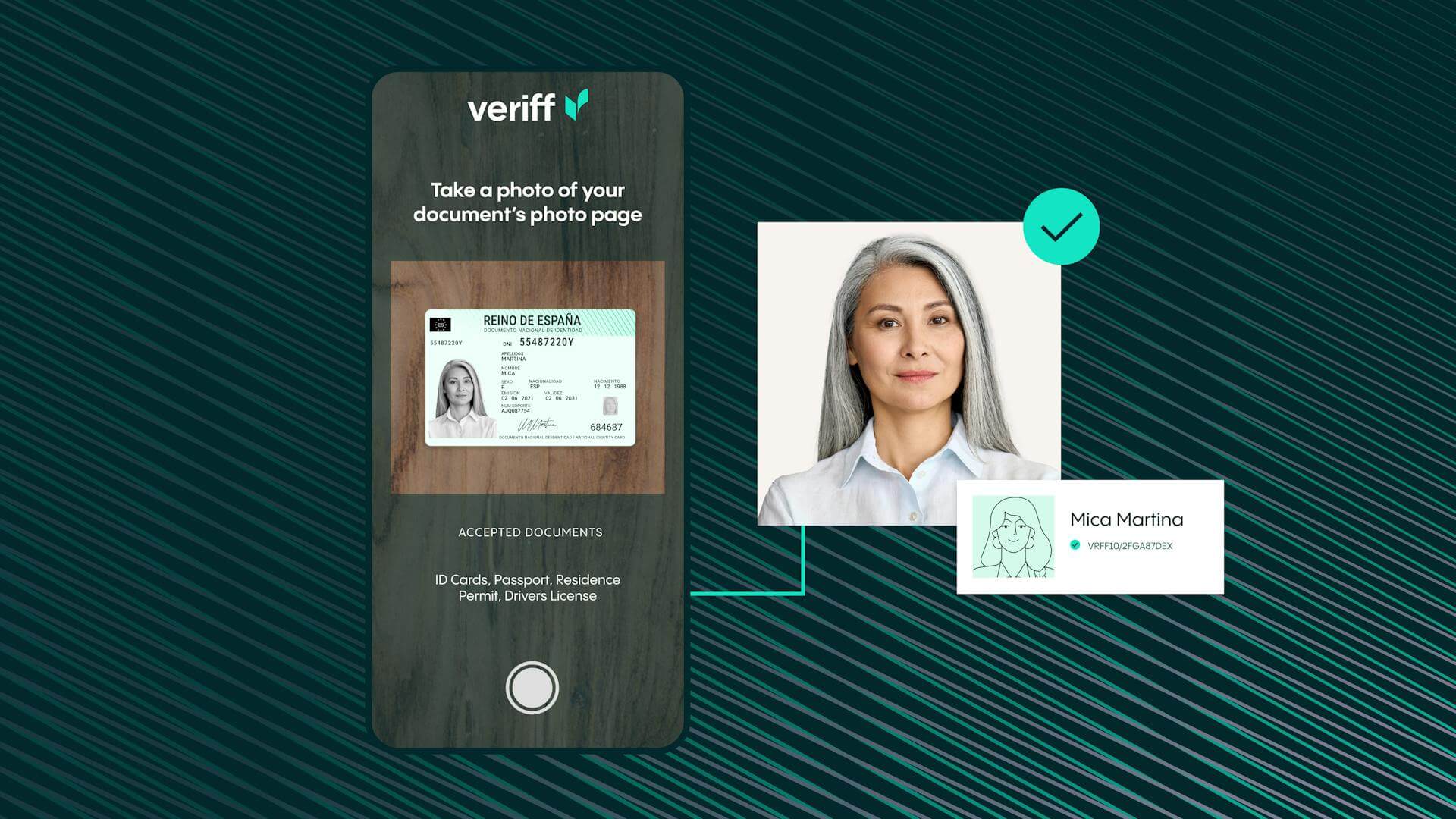

A typical identity verification (IDV) session will have two components that are being compared: a document that’s being verified and a person participating in the session. Both these elements are analyzed using sophisticated algorithms that can be revised and refined as more and more data becomes available from sessions.

Documents are scanned using optical character recognition (OCR) models that compare the session example to the thousands of specimens in our repository, looking for evidence of tampering or anything that fails to fit with expectations.

Veriff’s IDV solution integrates live video of the session participant, so it also employs models to analyze the face itself. As well as biometric analysis to ensure the person present in the video looks like the face on the document, models incorporate more advanced features such as liveness detection. This helps identify attempts at deception – from the most basic, where people literally wear masks or present images from the screen of another device, right up to the emerging technology of deepfakes. Veriff analyzes the device and network used for a verification session and assigns each a fingerprint. That data then goes through rigorous KYC checks.

Dynamic intelligence

As well as looking at the elements within a session, a key pillar of developing a sophisticated anti-fraud strategy is crosslinking. This enables fraud prevention teams to look for patterns across multiple sessions.

For example, an IP address may not be suspicious in itself, but if the same IP address is linked to multiple sessions for different accounts over a short period of time, this may be a red flag. Similarly, if the same identity document pops up repeatedly in different IDV sessions, it’s likely to warrant further investigation.

Crosslinking allows Veriff to group together sessions that share similar data points. Based on previous knowledge, fraudsters don’t tend to limit themselves to one try – they’ll try to get verified today, tomorrow and in the upcoming months and they won’t stop as long as they have fake identities. All the information from crosslinks is taken into account by our automatic decision engine, and is forwarded to our clients.

Expert intelligence

Where fraud prevention teams have enough deep domain expertise and access to sufficient data, it becomes possible to put together even more advanced anti-fraud models. By slicing and dicing data in different ways, such as analyzing patterns over time, or within particular industries or regions, it becomes possible to create truly bespoke strategies that focus on the particular needs of a specific business.

To best tackle bad actors and aid businesses, the entire Veriff team boasts years of expertise, including a highly-trained Verification Specialists, our experienced and specialized legal team, anti-fraud experts, and document specialists.

Packaging anti-fraud intelligence for customers

The next step in creating an effective solution is to package anti-fraud intelligence so that it can easily be consumed and acted upon by businesses.

As well as rules engines that can take all the available data and make decisions on a customer’s behalf, Veriff has experts who can make sure your systems are tuned and reacting to changes. Alternatively, for clients who have the technology and resource inhouse, data signals can be delivered directly as a raw feed. This enables businesses to tune and refine their own strategies to fit their shifting risk appetite.

Other refinements Veriff offers for specific clients include automated “blocklists” that block known fraudsters based on their facial features, and machine-learning-based risk identification that focuses extra attention on sessions classified as highly risky, based on criteria previously agreed with the client.

Communication and partnership

Veriff is proud to partner with major businesses in sectors as diverse as financial services, video gaming, mobility, marketplaces, and many others, allowing customers to expand globally with genuine users.

When it comes to fraud, the importance of strong communication and developing true partnerships with customers over time is compounded. This is because fraudsters are constantly and actively trying to bypass the anti-fraud measures businesses put in place.

However strong your fraud prevention strategy, what works to keep bad actors at bay today won’t necessarily keep doing the job effectively tomorrow. So regular reviews and discussions are vital to understand pain points and identify issues, backed up by constant tuning and refining to keep your fraud prevention strategy fit for purpose.

Get more details

To find out more about how Veriff’s fraud prevention solutions can help you address the threat to your business from bad actors, visit our Fraud Education Center.