KYC Article

Crypto KYC and blockchain

Crypto KYC is the first step in the anti-money laundering (AML) due diligence process. When a financial institution such as a crypto exchange onboards a new customer, they must use KYC processes in order to identify and verify the customer’s identity.

As the cryptocurrency industry continues to grow and mature, businesses in the industry have been asked to implement KYC processes similar to those adopted by financial services businesses.

In this guide, we’ll cover what these crypto KYC processes involve, why they need to be implemented, and the benefits they provide.

What’s the role of KYC in crypto?

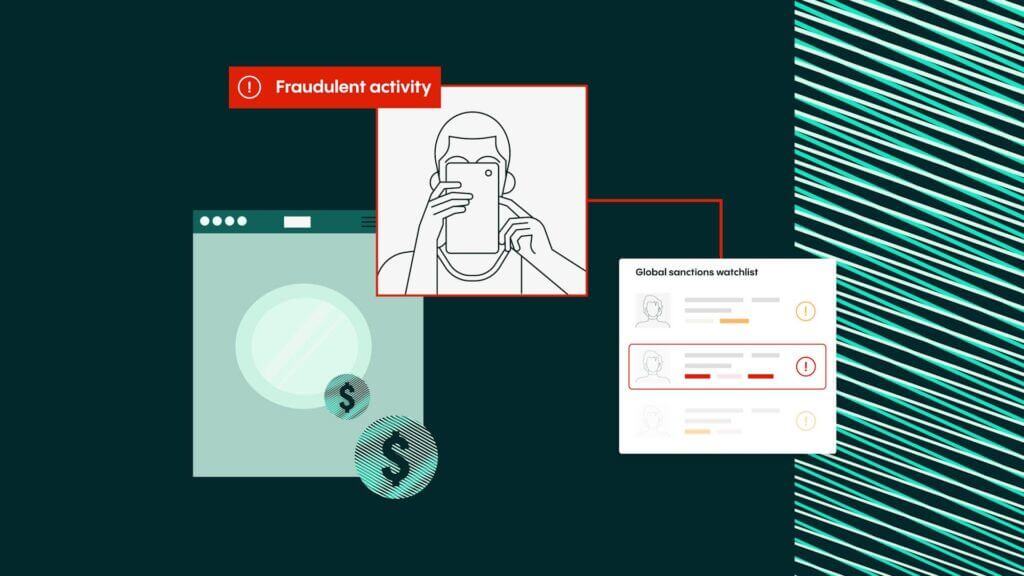

Cryptocurrency transactions between users are generally anonymous and take place in seconds. Due to the speed of the transactions and the anonymity provided, criminals sometimes use cryptocurrencies in an attempt to evade conventional controls relating to money laundering.

However, global regulators are beginning to pay closer attention to crypto transactions. Now, crypto exchanges and wallet providers are being asked to address the anonymity concerns associated with cryptocurrency transactions by implementing suitable know your customer (KYC) processes.

Crypto KYC is the first step in the anti-money laundering (AML) due diligence process. When a financial institution such as a crypto exchange onboards a new customer, they must use KYC processes in order to identify and verify the customer’s identity. In carrying out the process, they must also assess the customer’s risk profile and the nature of the business relationship.

Why do crypto exchanges require KYC?

KYC is now mandatory for most crypto exchanges and crypto wallet providers because they’re defined as MSBs (money service businesses) under federal regulations in the US.

It’s thought that enforcing crypto KYC compliance will help tackle malicious activity adjacent to the crypto space, such as ransomware attacks. At present, attackers are able to leverage the anonymity provided by decentralized cryptocurrencies to evade detection.

On top of this, regulators and industry leaders also hope that the introduction of crypto KYC processes will help improve the crypto sector’s public image. This is because stronger compliance procedures could help crypto shed its perceived association with money laundering and other criminal enterprises.

The challenge for KYC in crypto

By its very nature, the crypto industry is prone to problems regarding KYC. After all, the blockchain and decentralized services as a whole have been designed specifically to promote anonymity and to shun central authorities.

Due to this, many crypto firms have no idea who their customers are. Plus, many crypto buyers and traders have traditionally prized their privacy and have no desire to share their personal data with either crypto providers or the government. Instead, they feel that KYC checks are intrusive and unnecessary during the onboarding process.

However, in recent years, regulators have successfully convinced many of the world’s largest crypto firms that the current situation is unacceptable. Faced with the prospect of huge penalties and fines, even the most reluctant crypto firms have been compelled to introduce crypto KYC measures. This is partially because companies who have failed to implement effective crypto KYC safeguards have faced fines in excess of $100 million.

On top of this, the crypto market remains in flux. After all, although reputable crypto firms have now implemented KYC measures, it remains possible for investors to buy crypto without going through KYC processes. However, these exchanges are incredibly risky to use.

Similarly, around the world, crypto KYC measures vary. For example, in the US, FinCEN requires cryptocurrency exchanges to use KYC standards and also practice anti-money laundering measures to achieve regulatory compliance. However, in the EU, standards are not currently as high.

How does KYC and blockchain overlap?

Some experts in the crypto space believe that successfully incorporating KYC into blockchain platforms would be a positive change. This is because using blockchain technology for KYC would provide:

- Greater operational efficiency

- Real time and up-to-date customer data

- Immutability and transparency

On top of this, blockchain technology could also offer regulators a better understanding of how customers have been onboarded. If all actions by financial institutions are fully recorded and tracked, all activity data will be fully auditable. This information would also help regulators to better understand customer activity.

Plus, by using blockchain technology for crypto KYC, financial institutions will also be able to improve the customer experience by making processes more timely and efficient.

How to be KYC compliant in crypto

Now crypto businesses are regulated as financial institutions, they must integrate KYC processes into their anti-money laundering programs. In doing so, they must take appropriate steps to:

- Collect appropriate personally identifiable information (PII) from the customer

- Verify the identity of the customer

- Acquire a better understanding of the customer’s activities

- Determine the probability that the customer poses a money laundering risk

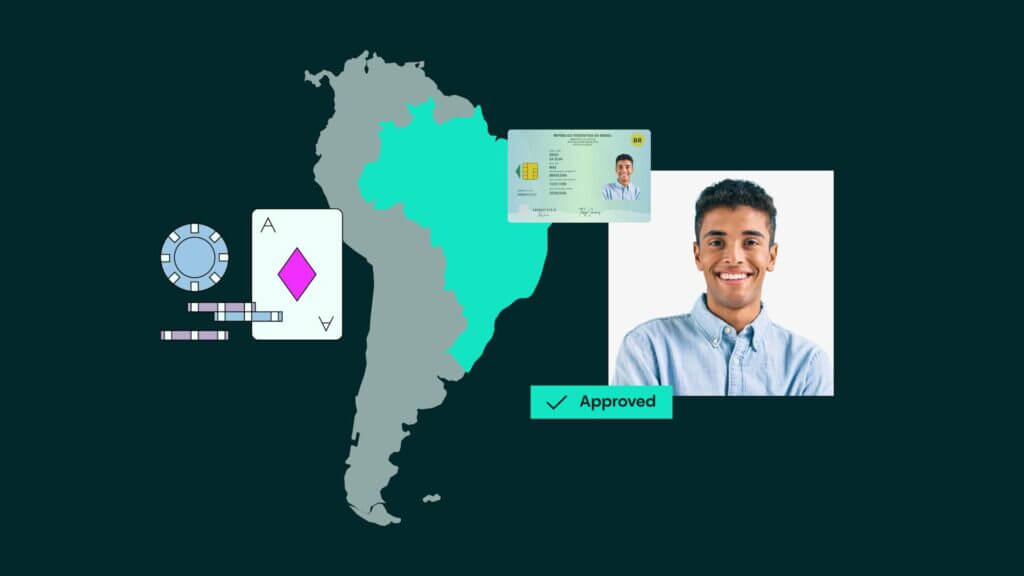

To do this, most crypto exchanges and wallet providers will follow these steps:

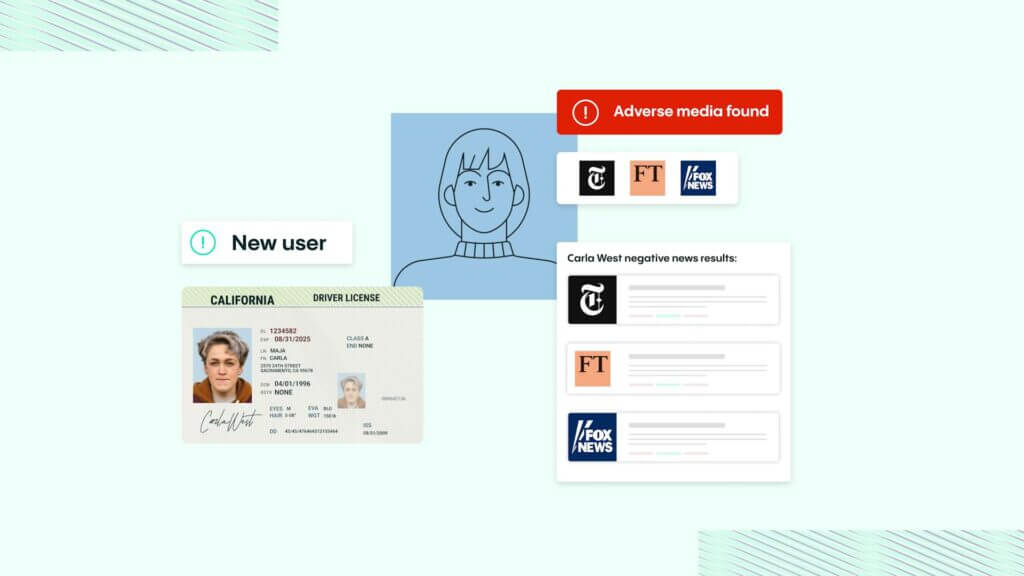

- Step one: Collect the customer’s PII, including their full name, date of birth, and address

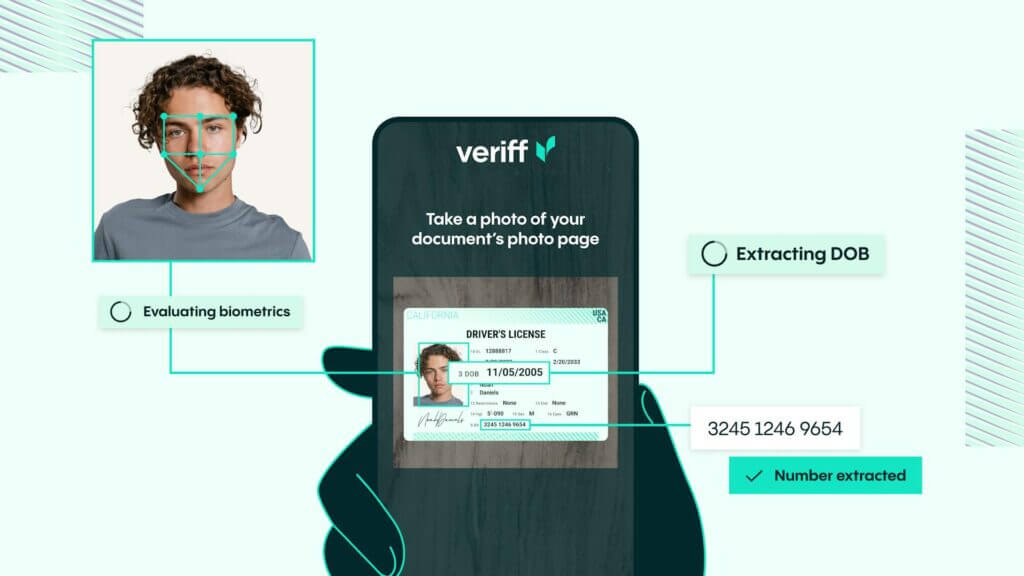

- Step two: Compare this information to a government-issued document, such as a passport or driving license. During this step of the process, the business must also verify the authenticity of the government-issued document

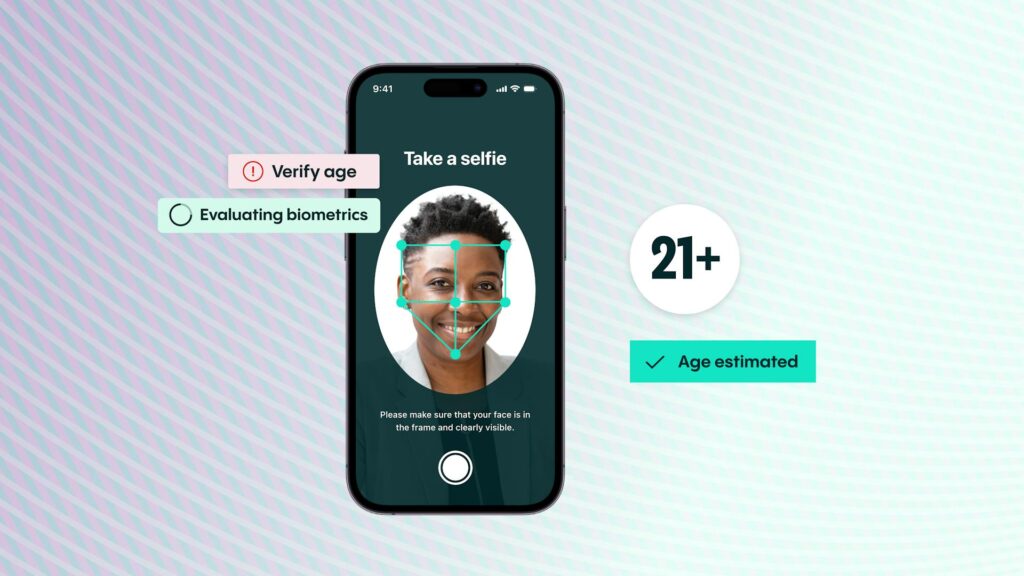

- Step three: Ask the customer for a selfie. This is then used to verify that the person who is providing the information is the person who is pictured on the government-issued document

- Step four: Verify the customer’s identity against official databases that contain information on politically exposed persons (PEP) and sanctioned individuals

In carrying out these steps, crypto businesses can determine the risk of money laundering and financial crime involving virtual currencies for each client. If required, they can then carry out additional due diligence checks. If the customer passes these checks, they can then be allowed to access the service.

However, the crypto KYC process doesn’t end when a customer has been successfully onboarded. This is because the customer must also be monitored on an ongoing basis. This is to ensure that any suspicious transactions can be spotted and, if necessary, reported to authorities.

Benefits of KYC for crypto

Although there’s some opposition to KYC in the crypto space, the process actually provides businesses with a number of benefits, including:

Improved customer transparency and trust

Crypto KYC can increase transparency and trust among customers. This is because, when all user identities are verified, customers will feel confident that their crypto exchange is taking proactive and preventive measures to protect their account and their crypto. As a result, they’re more likely to continue using the service because they trust it.

Reduced risk for money laundering

When all identities are verified and crypto exchanges know their customers, the risk of money laundering is vastly reduced. This is because vigorous identity verification processes ensure that each customer is legitimate. This then significantly reduces fraudulent activity and improves market reputation.

Reduced legal risks

Legal obligations in the crypto space are continually changing and evolving. Now, crypto businesses face greater regulatory challenges than ever before.

But, by implementing robust crypto KYC processes now, businesses can stay ahead of the curve. Instead of chasing after new regulations, they can focus on increasing conversion rates, streamlining transactions, and ensuring compliance as international guidelines evolve.

On top of this, by continually staying on top of regulatory changes, businesses can ensure they’re always compliant. In doing so, they can avoid the strict penalties that can be handed down by regulators.

Improved crypto market stability

The cryptocurrency market is notoriously volatile. However, much of this volatility is driven by instability and the suspicious nature of some anonymous transactions. By removing anonymity from the process, crypto KYC can bring stability to the market.

How Veriff solves KYC for crypto

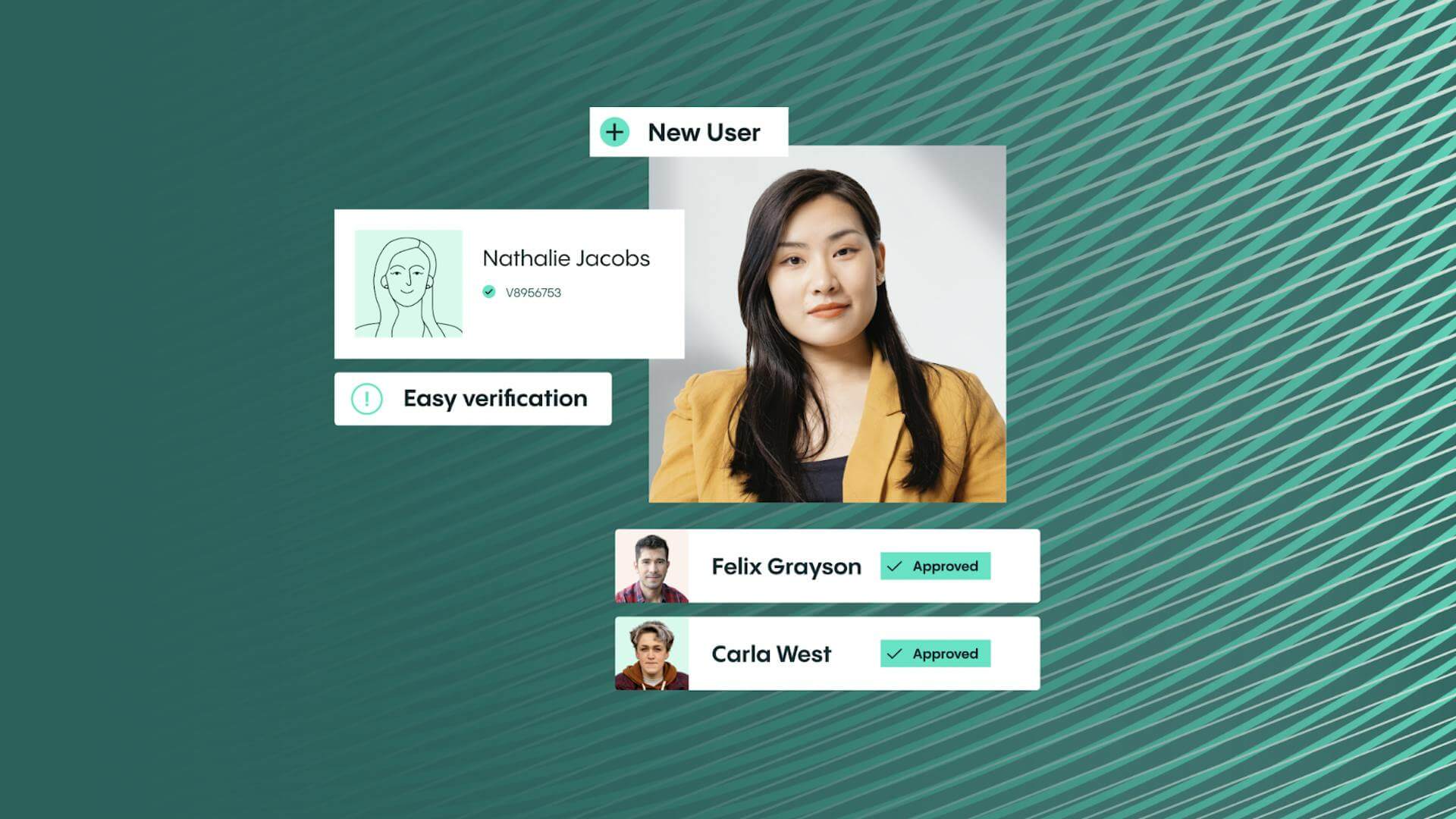

Here at Veriff, we make investing in crypto safe and easy. This is because our selfie-based crypto identity verification platform provides industry-leading conversion rates and high levels of fraud prevention.

Our purpose-built solution provides global compliance. With our help, you can satisfy FINRA, SEC, and GDPR requirements, as well as enforce AMLD6 guidelines. Plus, you can verify your customers in as little as six seconds and verify 95% of your customers on the first try.

Speak with the KYC compliance experts at Veriff

Our crypto KYC compliance experts are available to help you. If you’d like to learn more about how our crypto identity verification solution can help you meet your crypto KYC obligations, get in touch with the team today. We’d love to provide you with a personalized demo that shows exactly how we can help you meet your goals.