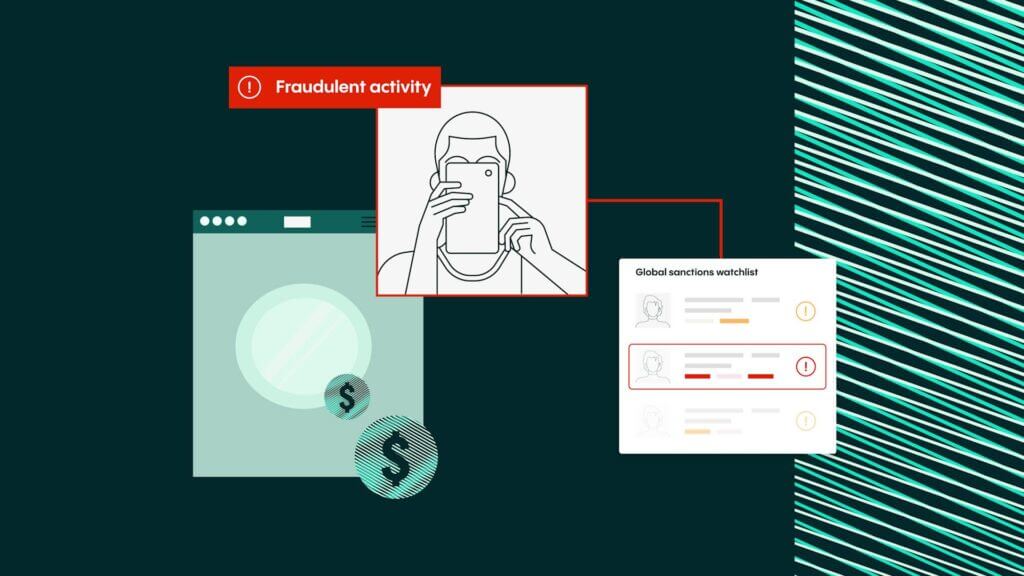

Financial institutions face a constant battle against money laundering, a crime that uses complex schemes to move illegally obtained funds into the legitimate financial system. One common method is structuring, and as technology evolves, so do the tactics of those who seek to exploit the system. This guide explains what structuring is, how it works,

Structuring, fraud, and the future of bank security