Fraud Article

AI tax scams target refunds: a wake-up call for businesses

Last month, with the 2024 tax season on the horizon, there was a noticeable surge in tax-related fraud perpetrated by AI-powered cybercriminals.

In the era where financial operations are increasingly intertwined with cutting-edge technology, the infusion of Artificial Intelligence (AI) into the financial sector signifies a monumental shift. This evolution holds particularly significant implications in the realm of tax compliance, where AI’s potential to bolster defenses against tax scams is both revolutionary and imperative. Last month, as the 2024 tax season approached, an increase in tax-related fraud, driven by AI-enabled cybercriminals, loomed ominously over the financial landscape. Understanding the depth of this issue and the countermeasures available is crucial for compliance officers, businesses, financial enterprises, and finance professionals. Understanding the depth of this issue and the countermeasures available is crucial for compliance officers, businesses, financial enterprises, and finance professionals.

Introduction to AI in the financial sector

The financial industry’s adoption of AI is transforming archaic processes into dynamic, efficient operations. Beyond automating mundane tasks, AI’s analytical prowess is revolutionizing risk assessment, decision-making, and, critically, fraud detection According to the Report by Axios, its role in tax compliance and fraud deterrence is becoming increasingly indispensable as the complexity and sophistication of financial crimes escalate.

Understanding tax scams

Tax scams, particularly those involving identity theft, present a formidable challenge. By fabricating tax returns using stolen personal information, fraudsters illicitly claim refunds intended for unsuspecting taxpayers. The IRS’s alarming figure of 294,138 identity theft complaints in 2023 underscores the magnitude of this issue. The advent of AI, with its capacity to generate convincing forgeries, amplifies the prowess of these cyber criminals, enabling them to bypass traditional security measures with disturbing efficiency.

AI’s role in detecting tax scams

In the face of these challenges, AI emerges as a beacon of hope. Its ability to sift through vast datasets at unprecedented speeds allows it to identify anomalies and patterns indicative of fraudulent activity. Furthermore, its self-learning capabilities ensure that it evolves in tandem with the tactics employed by tax scammers. The U.S. Treasury’s identification of $375 million in fraudulent transactions in 2023 showcases AI’s potential as a formidable adversary against tax fraud.

Tips for businesses and finance professionals

To combat the escalating threat of AI-powered tax scams, businesses must adopt an all-encompassing approach. This necessitates the strengthening of cybersecurity measures, the provision of up-to-date scam awareness training for personnel, and the strategic application of AI technologies to adeptly identify and mitigate fraudulent endeavors. Furthermore, establishing collaborative relationships with financial institutions and regulatory authorities is crucial in augmenting defensive capabilities and ensuring prompt responses to emergent threats.

Equally important is the role of visionary accounting firms in leading the charge to develop and adhere to ethical AI guidelines. By doing so, they not only safeguard their operations but also contribute to fostering a safer digital ecosystem for all stakeholders involved. Veriff stands at the forefront of this initiative, offering advanced AI-powered verification solutions that embody the principles of security, trust, and expertise. Through our commitment to creating a more secure internet, we empower businesses to confidently navigate the complexities of the digital age while protecting their assets and reputation against sophisticated online threats.

Additionally, the IRS recommends practices such as filing returns early, opting for direct deposit for refunds, and securing personal and business IRS accounts. Awareness and vigilance in recognizing and reporting phishing attempts are also critical in safeguarding against identity theft.

DOWNLOAD NOW!

Explore the latest insights into digital fraud trends with the Veriff Fraud Index 2024.

Conclusion

The integration of AI into tax compliance and fraud detection heralds a new epoch in the financial sector. Its sophisticated analytical capabilities, coupled with its evolving nature, make it an invaluable ally in the battle against tax scams. Nonetheless, as we navigate this new terrain, awareness, and proactive measures remain our best defense. Businesses and financial enterprises must remain vigilant, adopting AI-driven tax solutions while fostering a culture of cybersecurity. The dawn of AI in tax compliance not only enhances the efficiency of tax processes but also fortifies the integrity of financial systems against the scourge of tax fraud.

How Veriff can help?

Navigating the future of fraud prevention with advanced biometric solutions

In an era where digital advancements rapidly evolve, the threat landscape shifts with equal velocity, presenting intricate challenges in online security and fraud prevention. Veriff stands at the forefront of combating these threats through innovative real-time remote biometric identification solutions, leveraging the cutting-edge capabilities of artificial intelligence (AI) and machine learning.

The AI-driven approach to biometric identification

Our commitment to enhancing the security framework for businesses and organizations worldwide is underscored by our continuous development in AI and machine learning technologies. These advancements significantly amplify our identification processes’ speed, safety, and efficiency. Operating on a global scale requires a deep understanding of the varied legal environments, and our robust legal teams are adept at navigating these complexities.

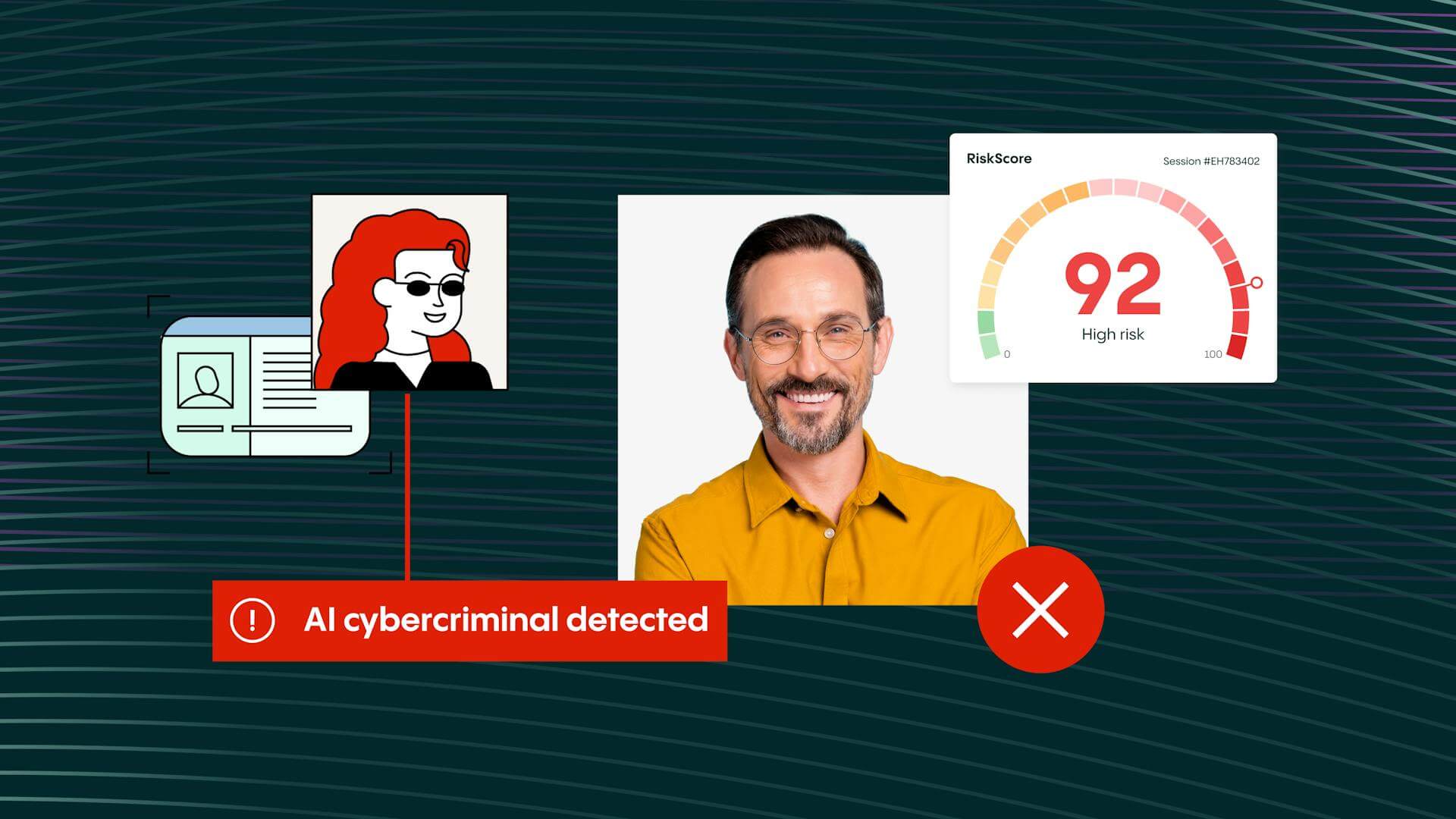

Combatting deepfakes and AI-generated media

With the emergence of deepfake technology and AI-generated media, the risk of impersonation fraud has escalated. Veriff addresses this burgeoning threat with a comprehensive strategy that includes our advanced FaceCheck Liveness technology. This solution utilizes sophisticated algorithms designed to validate genuine human presence without necessitating any user action, effectively mitigating the risk of digital manipulation.

Further enhancing our security measures, DocCheck and DeviceCheck play pivotal roles in authenticating documents and analyzing data points from devices, respectively. These checks are essential in detecting anomalies that may indicate fraudulent activities, such as synthetic identities and multi-accounting.

Real-time fraud detection with CrossLinks

Our CrossLinks technology underscores our capability to uncover and combat complex fraud patterns in real time. By analyzing connections between different verification sessions, CrossLinks can identify potential fraud rings and synthetic identities, significantly bolstering our fraud detection mechanisms.

Introducing Fraud Protect and Fraud Intelligence

The introduction of our Fraud Protect package marks a significant milestone in our mission to safeguard organizations from various facets of online fraud. It is designed to protect businesses during the IDV process while minimizing friction for genuine users, and includes various checks ensuring we onboard trustworthy users. It also includes Velocity Abuse Prevention, which is tailored to deter velocity abuse and multi-accounting, thus maintaining the integrity of processes such as electoral voting.

Our RiskScore, integrated in Veriff’s Fraud Intelligence, offers a comprehensive insight into risks associated with users, allowing organizations to incorporate valuable risk intelligence into their decision-making processes. This advanced approach empowers organizations to build sophisticated counter-fraud strategies and conduct thorough investigations when necessary.