Blog Post

7 high-risk customer types and how to identify them

High-risk customers are individuals who could pose a threat to your company and its operations. In the online world, these individuals could cause a compliance issue, commit fraud, or attempt to cause a cyber security breach.

Regulated firms such as financial institutions are required to take a risk-based approach to customer due diligence (CDD) and ongoing monitoring. To prevent fraud, terrorist financing, and money laundering, firms must identify high-risk customers and undertake enhanced due diligence (EDD) processes.

Here we’ll explain everything there is to know about high-risk customer types and the people you should be looking to identify. But, before we do this, let’s first take a look at exactly what we mean by ‘high-risk customers’.

Who are high-risk customers?

High-risk customers are individuals who could pose a threat to your company and its operations. In the online world, these individuals could cause a compliance issue, commit fraud, or attempt to cause a cyber security breach.

Risk takes many different forms depending on the industry you’re involved in. For example, a high-risk customer could:

- Take over another user’s account

- Attempt to launder money

- Borrow money with the intention of defaulting

- Create an account using someone else’s identity

When it comes to AML and customer due diligence for banks and financial institutions specifically, high-risk customers are individuals who pose the highest level of money laundering risk. This includes:

- Customers linked to higher-risk countries or business sectors

- Customers who have unnecessarily complex or opaque beneficial ownership structures

- Customers who make transactions that are unusual, lack an obvious economic or lawful purpose, or are complex

7 high-risk customer types

In order to identify high-risk customers, businesses must understand exactly where risk lies within their industry. To help you with this, here are seven high-risk customer types that your financial services business may encounter:

Customers with links to high-risk countries

Some countries pose a higher level of money laundering risk than others. This is because many countries around the world, such as the Democratic People’s Republic of Korea, Iran, and Myanmar have been found to have strategic deficiencies in their anti-money laundering and counter-terrorism financing (AML/CTF) regimes. Due to this, many fraudulent actors establish links to these countries in an attempt to launder their money.

The Financial Action Task Force (FATF) regularly updates its list of high-risk countries. You can find it here. The FATF also publishes a list of countries that are subject to increased monitoring.

Customers with links to high-risk business sectors

Similarly, some sectors are viewed as posing a higher risk of money laundering than others. For example, if a customer is linked to a cash-intensive business such as a launderette or a nail salon that has suspiciously high earnings, then this may suggest that the business is linked to money laundering.

On top of this, it’s also important to note that high-risk customers who are attempting to launder money will also target businesses from certain sectors. For example, they may attempt to purchase art, property, or cars using cash. This is because, if the fraudster is successful, they can launder a large amount of cash in a single transaction. For this reason, business owners in these sectors must be particularly vigilant.

Customers with complex ownership structures

If you spot that a business has a complex ownership structure, then this could be a money laundering red flag. This is because complex structures are usually created in order to hide the proceeds of crime.

Financial institutions must identify who the ultimate beneficial owner of a company is. The FATF defines a beneficial owner as “the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes persons who exercise ultimate effective control over a legal person or arrangement.”

If you struggle to establish who the beneficial owner is or discover that a company’s structure appears to be unnecessarily complex and based in an offshore tax haven, then you should ask the customer for further information. Setting up a complex corporate structure is not illegal, and most aren’t set up with any malice or ill intent. However, it is key to recognize that they can be used for money laundering purposes.

Customers with unusual account activity

Once a customer has been onboarded, you must monitor their account activities and transactions in order to ensure that these are consistent with the risk profile you initially established. For example, if a customer suddenly starts to deposit large amounts of cash, transfers funds to another country regularly, or starts to send money to another high-risk individual, this is a sign that the customer’s risk profile is changing and must be monitored more closely.

Politically exposed people (PEPs)

Politically exposed people (also sometimes referred to as politically exposed persons) are individuals whose prominent position in public life may make them vulnerable to corruption.

The FATF defines a PEP as “an individual who is or has been entrusted with a prominent public function. Due to their position and influence, it is recognized that many PEPs are in positions that potentially can be abused for the purpose of committing money laundering (ML) offences and related predicate offences, including corruption and bribery, as well as conducting activity related to terrorist financing (TF).” As well as the individual in question, the PEP definition also extends to this person’s family members and known associates.

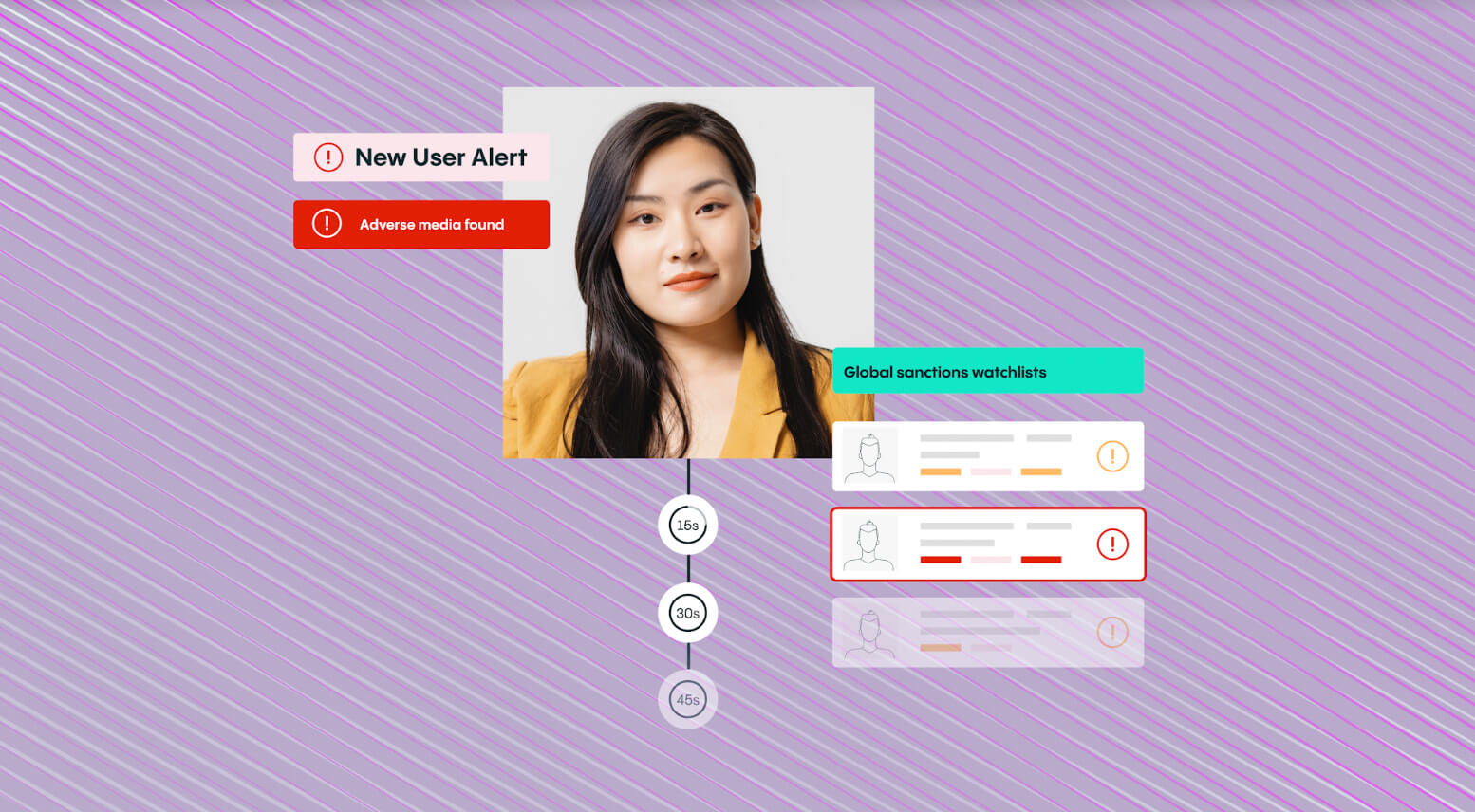

Customers with dubious reputations

Both during the onboarding phase and throughout the business relationship, you should screen your customers for adverse media. If you find that there are a number of news sources that link this customer to alleged involvement in money laundering, terrorist financing, trafficking, sanctions, and other forms of illegal activity, then this signifies that they are a high-risk customer who needs to be monitored closely.

Adverse media sources can include traditional news sources and media, international databases, blogs, web articles, and newswires. A number of customer due diligence solutions, such as ours, can screen for adverse media automatically and notify you if anything changes.

Non-residential customers

Finally, if a customer attempting to sign-up for an account with your company is not a resident, then this also signifies that they are a high-risk individual. This is particularly the case if there isn’t a business case for the customer opening an account with your company.

In these instances, the customer in question could be attempting to launder funds through your company. They may also be attempting to avoid reporting requirements by setting up accounts with multiple companies in different jurisdictions.

See how Veriff’s screening solutions can reduce risk – Book a demo

Here at Veriff, we’ve developed an AML screening solution that can reduce risk for your business at every turn.

Our anti-money laundering screening tool helps you maintain regulatory compliance while also actively increasing your conversion rate. It works by deploying our identity verification service alongside politically exposed person and sanctions checks, as well as adverse media screening, and ongoing customer monitoring.

If you’d like to discover more about how our AML screening solution can help your business reduce risk, get in touch with our experts today. We’d love to provide you with a personalized demo that shows exactly how we can support your AML efforts.